Consistency is more powerful than luck

- 2025年9月12日

- Posted by: EagleTrader

- Categories: Trading knowledge

Long-term success in trading is not about luck or chasing quick wins, but about discipline, patience, and emotional control. In this Q&A, three EagleTrader Traders reveal how they overcame challenges, managed risk, and stayed consistent to succeed in the Evaluation Process.

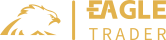

Trader Mercedesz: “Stay distributed and don’t rush the process.”

How did lost limits affect your trading style?

They taught me discipline. I was forced to respect risk, avoid overlivering, and focus on consistency instead of chasing profits.

What does your risk management plan look like?

I risk a fixed percentage per trade, usually between 0.5–1.5%, with clear Stop Loss levels. I also avoid trading during high-impact news.

What do you think is the key for long term success in trading?

Patience, discipline, and emotional intelligence. Trading is not about a big win, but about managing risk and being consistent.

How does passing the EagleTrader Challenge and Verification change your life?

It gave me confidence and freedom, and proved that a structured, distributed approach works in trading.

What was the hardest obstacle on your trading journey?

Overcoming emotions, especially fear of loss and greed and controlling psychology.

What would you like to say to other traders that are attempting the EagleTrader Challenge?

Stay distributed, trust and don’t rush the process. Consistency is more powerful than lucky.

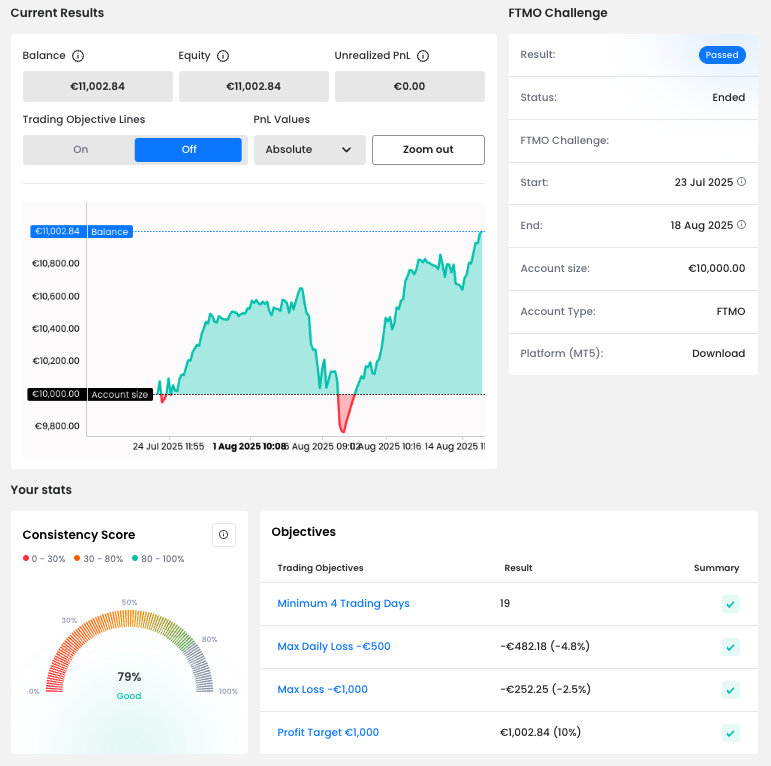

Trader Muhammad: “Patience and practice are the real key.”

How did you manage your emotions when you were in a losing trade?

I always use a Stop Loss and believe in reward-risk ratio. That helped me manage emotions when facing losses.

What was easier than expected during the EagleTrader Challenge or Verification?

The time limit. It was easier for me because I felt no pressure – I had enough time to complete both steps.

What was the most difficult during your EagleTrader Challenge or Verification and how did you overcome it?

It was the last few trades when I was close to completing the EagleTrader Verification. I took a one-day break and traded with a fresh mind.

What do you think is the key for long term success in trading?

Risk management is the key for long term success, especially discipline in trading.

How does passing the EagleTrader Challenge and Verification change your life?

It makes me feel that I can trade within limitations and push myself further. That could be life-changing for me.

What is the number one advice you would give to a new trader?

I would love to tell a newbie that patience and practice before actual trading are the real key. The longer you sustainable, the more success you can achieve in trading. Keep the emotions away from trading.

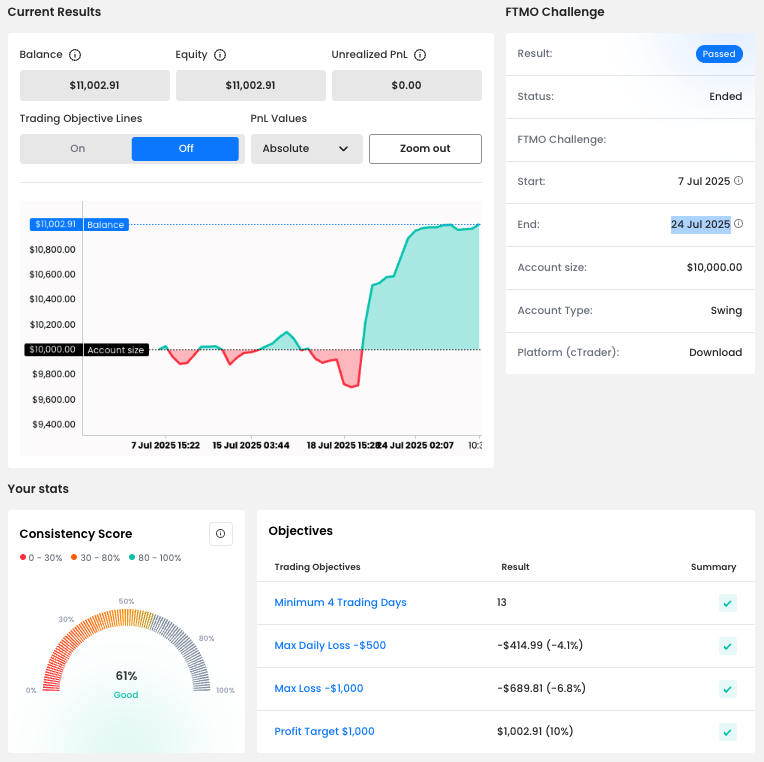

Trader Remus-Iulian: “Staying away from the charts is the key in many cases.”

What was themost difficult during your EagleTrader Challenge or Verification and how did you overcome it?

The most difficult thing was to realize that it was all about emotions and execution.

How would you rate your experience with EagleTrader?

10/10

What was more difficult than expected during your EagleTrader Challenge or Verification?

During the EagleTrader Verification, I had to accept that it could be harder than Phase 1 because you are so close to the funded stage.

What inspires you to pursue trading?

I discovered trading 3 years ago, and itwas something I didn’t want to give up. I had an EagleTrader Account in 2023, but I didn’t yet have the knowledge to keep it. To be honest, I see the potential in trading and the opportunities it can give you.

How did you manage your emotions when you were in a losing trade?

I realized that staying away from the charts is the key in many cases. So I forced myself to just close the charts, and find something else to do.

What is the number one advice you would give to a new trader?

Manage your risk, and allow your edge to be presented over a large sample of trades, not by risking all in 3 or 4 trades.